EDIT A PENDING PT-61 E-FILING HELP

Need help Editing a Pending PT-61 E-Filing?

To repeat the information from the overview page:

- When you first start the retrieval process you are presented with two options. Option one allows you to Create a New PT-61 based upon an existing filing. Option two allows you to Edit a Pending PT-61.

- You can choose to Edit a Pending PT-61 to edit an existing but un-filed PT-61 to correct errors or add data. The original PT-61 number WILL BE DELETED and a NEW PT-61 NUMBER will be assigned. It is your responsibility to discard the old PT-61 after editing and file the new PT-61 document number at the courthouse! If you incorrectly selected the Edit Pending PT-61 option when you were trying to Create a New PT-61 form, your filing will be rejected and you may be required to re-file correct forms at the county!

- You may want to use this feature if you have submitted a PT-61 and discover that some of the information is incorrect. Editing the filing will allow you to correct the mistakes and render the original filing invalid.

To Edit a Pending PT-61 E-Filing, please use the following directions:

- On the left side of the home page (www.gsccca.org), click on File and then PT-61 E-Filing. Last click on PT-61 eFiling Portal.

- On the left side of the page, click Retrieve My PT-61 Filings.

- You will then have to log in if you have not already done so.

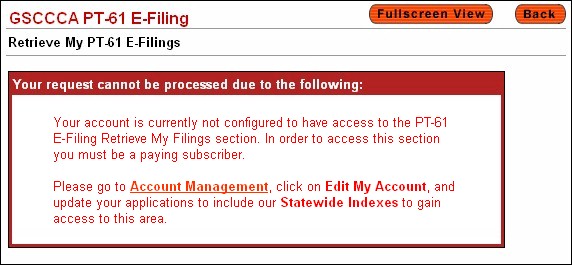

- If you are not a paying subscriber, you will receive the following message.

- Note: If you receive this message, please go to Account Management, click on Edit My Account, and update your applications to include our Statewide Indexes to gain access to this area.

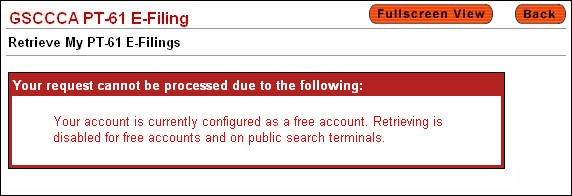

- If you have a free account or are trying to retrieve a filing from a public search terminal in one of the counties, you will receive the following message.

- Note: If you receive this message, please create a Regular Account or access the PT-61 Retrieve feature from another location.

- If you are a paying subscriber, you will see the following screen. To Edit a Pending PT-61, click the "Edit Pending PT-61" button as shown below.

- After you have clicked the Edit Pending PT-61 button. You will be presented with the following screen. Select whether you would like to Search By Document Number or by Name.

- To search by Document Number, click Document Number Search.

- Enter the Document Number and click Begin Search.

- If the filing is found, you will be presented with a confirmation box. If you wish to continue and Edit the Pending PT-61 filing click the yellow "Edit Pending PT-61" button as shown in the confirmation box below.

- To search by Name, click Name Search.

- Enter the name and click Begin Search.

- Click on the circle that best corresponds with the name for which you searched. Click on Display Details.

- Click on either the green S or B to edit the filing or create a new filing based on the current one.

- After clicking the S or B you will be presented with a confirmation box. If you wish to continue and Edit the Pending filing click the yellow "Edit Pending PT-61" button as shown in the confirmation box below.

- The PT-61 E-Filing entry form will now appear. Click on the section (Seller, Buyer, Property, or Tax) that contains the information you would like to edit.

- Edit the information.

- Click on the Preview and Accept section and make sure the information is correct. Check all three checkboxes in the Acceptance Section on the page as shown below. Then click Submit PT-61 Form.

-

Print out your corrected version of the PT-61 form.

- Note: The corrected version of the filing has its own unique PT-61 Document Number.

- Note: The incorrect version of the filing has been marked invalid in the system.

- Note: PLEASE DISCARD THE OLD PT-61 FILING THAT YOU EDITED! If you incorrectly selected the Edit Pending PT-61 option when you were trying to Create a New PT-61 form, your filing will be rejected and you may be required to re-file correct forms at the county!

|